"Top GCC Provider in India" - AIM Research

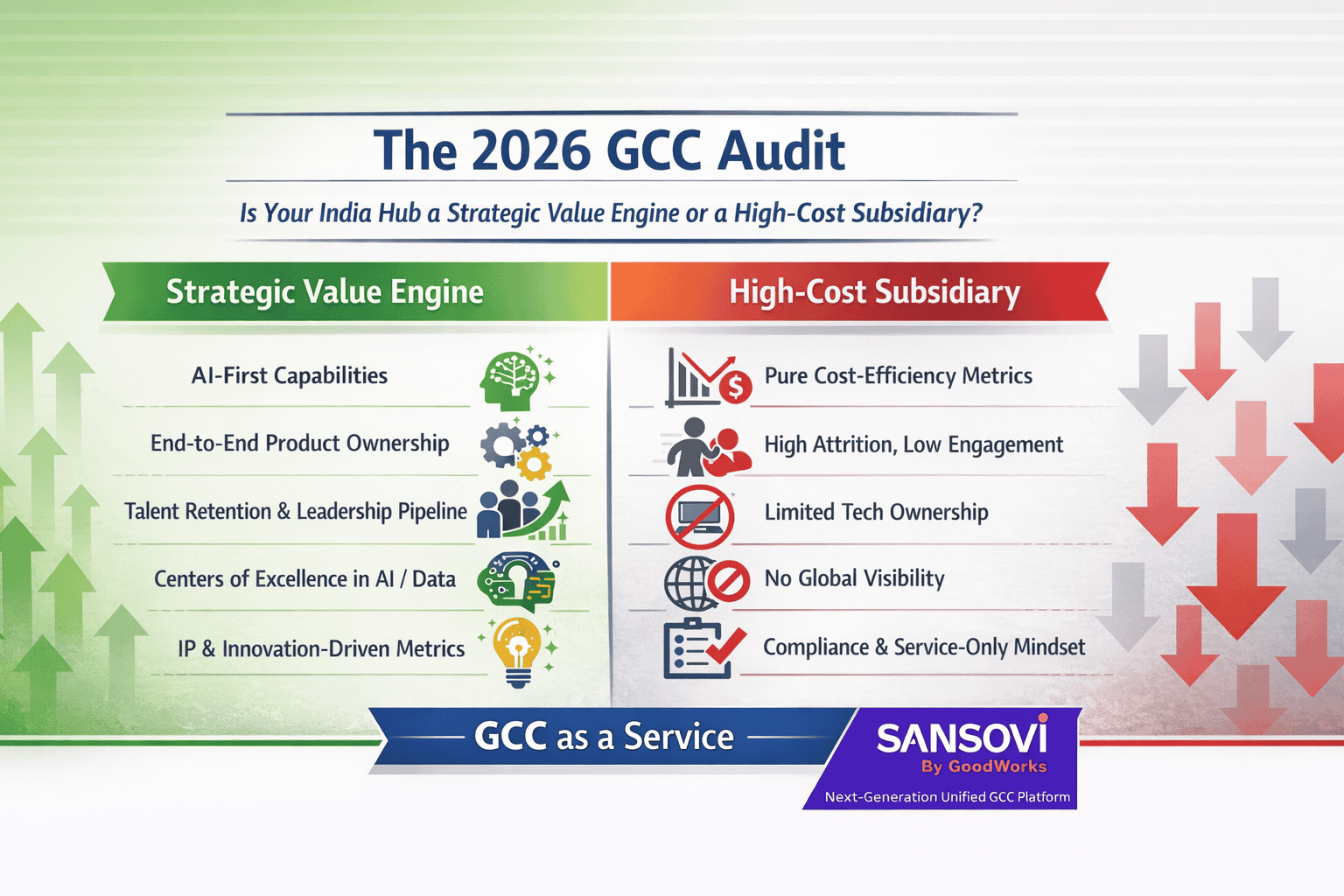

Read more.As we enter 2026, Global Capability Centers (GCCs) in India have become integral to enterprise value chains across industries. Yet, a pressing question looms in boardrooms and executive offsites: Is our India-based GCC delivering strategic value, or has it evolved into a high-cost, low-agility satellite?

This audit-centric approach is not about compliance. It’s a recalibration of purpose, performance, and potential. With India hosting over 1,800 GCCs as of 2025 and expected to cross 2,200 by 2027, the competitive landscape is shifting from scale to strategic differentiation.

GCC as a Service has emerged as a transformational model to build, scale, and operate global hubs with embedded innovation, agility, and governance.

Why 2026 Is a Tipping Point for GCCs in India

1. Cost Pressures Are Rising

Wage inflation, attrition, and increased cost of digital talent in Tier-1 cities like Bangalore and Hyderabad are squeezing margins. Enterprises can no longer justify India-based GCCs purely on labor arbitrage.

2. Boardroom Focus Has Shifted

CXOs and boards expect GCCs to be innovation-led, governance-driven, and digitally forward. GCCs that do not contribute to product velocity, customer experience, or AI transformation are under scrutiny.

3. Global Operating Models Are Evolving

From centralized IT hubs to distributed agile pods, the expectations from a modern GCC span engineering ownership, IP creation, AI/ML capabilities, and cross-functional collaboration. Legacy delivery centers are falling behind.

Strategic Value vs Subsidiary Mindset

Signs Your GCC Is a Strategic Value Engine

- Owns end-to-end delivery for core business functions (product, data, engineering)

- Generates intellectual property (IP) and is listed in patents and innovations

- Has defined P&L responsibility or direct contribution metrics

- Participates in global decision-making forums, not just local ops calls

- Attracts tier-1 talent and internal leadership mobility

- Runs Centers of Excellence in AI, data science, or automation

Signs Your GCC Is a High-Cost Subsidiary

- Functions as a support or shared service center only

- Measured by cost efficiency alone, not strategic outcomes

- Lacks visibility with corporate HQ and strategic leaders

- High attrition, low employee NPS, and talent poaching by competitors

- Minimal innovation, no active collaboration with startups or academia

GCC Performance Metrics That Matter in 2026

To reframe your India hub as a value center, leadership teams must adopt a new lens of evaluation. Here are five performance areas that leading enterprises track in their GCC strategy audits:

1. Business Alignment & Outcome Contribution

- Share of global revenue or customer journey owned

- Impact on speed-to-market or digital transformation goals

2. Innovation & IP Metrics

- Number of patents filed or innovations deployed from the GCC

- R&D contribution in global product cycles

3. Talent Quality & Retention

- Average tenure of top talent

- Leadership roles sourced from GCC to global positions

4. Technology Depth & Ownership

- Adoption of cloud-native, AI/ML, and data platforms

- Full-stack ownership across product lines

5. Governance, Risk & Compliance Maturity

- ISO/IEC certifications, SOC2 readiness, and data privacy frameworks

- Business continuity & resilience protocols

The Rise of AI-First GCCs in India

By 2026, AI is no longer a CoE or side project. Leading GCCs in Bangalore, Hyderabad, and Pune are now core contributors to AI models, LLM fine-tuning, and autonomous operations.

Features of AI-First GCCs:

- Embedded MLOps pipelines and data governance frameworks

- AI-driven customer support, risk detection, and personalization engines

- Dedicated AI squads aligned to business units

- Partnerships with IITs, IIITs, and global AI forums

Companies have expanded their India GCCs into full-blown digital innovation hubs, moving beyond back-office delivery. This is where GCC as a Service becomes critical — enabling scale, compliance, and transformation.

Cost Structure Isn’t the Enemy – Misalignment Is

Understanding TCO (Total Cost of Ownership) for GCCs in India

A rising cost base does not necessarily mean inefficiency. It could reflect:

- Transition to high-skill, high-value work

- Investments in security, compliance, and cloud platforms

- Hiring of product leaders, data scientists, architects

How to Rationalize Without Downsizing:

- Shift low-complexity work to Tier-2 cities like Coimbatore, Vizag, or Jaipur

- Adopt hybrid delivery models with agile pods and remote dev teams

- Invest in automation and GenAI-led ops

Redesigning Your GCC Operating Model in 2026

If your GCC isn’t a value engine yet, it’s not too late. Here’s how transformation leaders are rebuilding their India hubs:

1. Shift from Shared Services to Productized Capabilities

Build internal SLAs and ownership models that mimic product teams.

2. Move from Headcount to Capability Planning

Focus on skills, cloud certifications, innovation potential instead of just team size.

3. Enable Leadership, Not Just Execution

Empower India-based leaders to lead global programs and report into CXO teams.

4. Partner Strategically

Use GCC as a Service providers to handle infra, compliance, and scale while retaining core delivery and innovation in-house.

Conclusion: Turn Your GCC Into a Competitive Moat

As the global enterprise ecosystem becomes more volatile, your GCC in India can either become a competitive moat or a margin drag. It depends on how you structure, empower, and govern it.

The 2026 GCC audit is not a finance review – it’s a strategic health check of your global operating model. Through GCC as a Service, companies now have a powerful option to reset and realign their India hubs.

SansoviGCC by GoodWorks is an End-to-End GCC Solutions Platform to build, operate and scale GCCs in India.